Managing credit card payments wisely is crucial to maintaining financial health and avoiding the debt trap. Whether you’re new to credit or dealing with high balances, applying the right credit card repayment strategies can help you save money, build credit, and reduce stress.

In this post, you’ll learn everything about:

- Using your credit card grace period to avoid interest

- Fast and effective credit card debt repayment methods

- Why paying more than the credit card minimum payment is essential

- Plus, FAQs and a comparison table to guide your decisions

Table of Contents

What Are Credit Card Repayment Strategies?

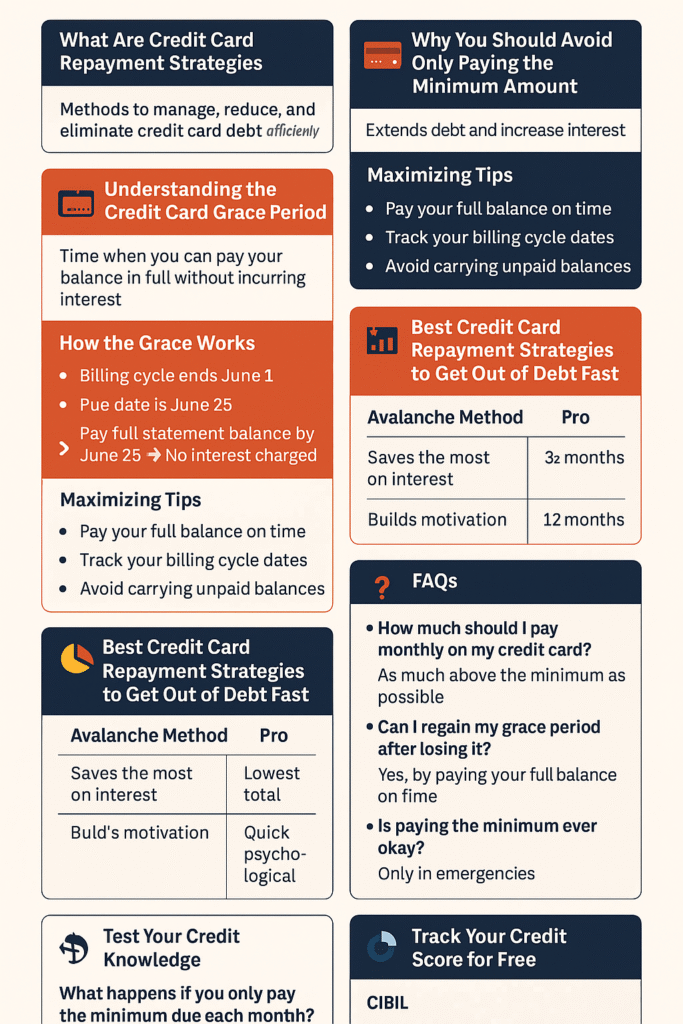

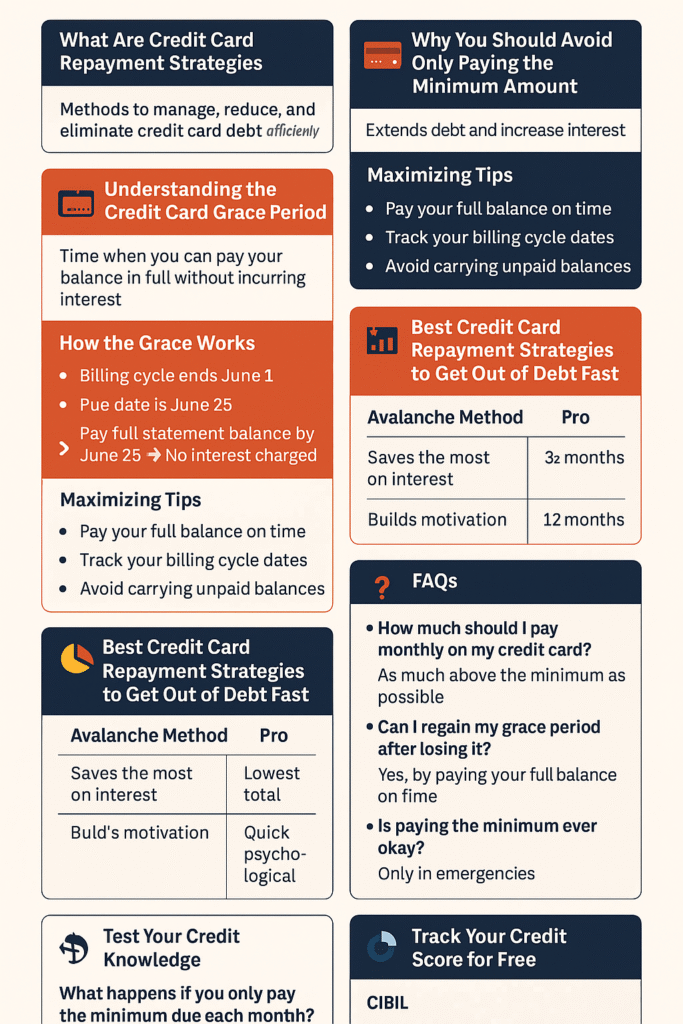

Credit card repayment strategies refer to the methods and habits you adopt to manage, reduce, and eliminate your credit card debt efficiently. These strategies include using interest-free periods, prioritizing certain payments, and understanding how minimum payments affect your finances.

Understanding the Credit Card Grace Period

One of the most overlooked repayment tools is the credit card grace period. This is the time between your billing cycle end date and your payment due date—usually 20 to 25 days—when you can pay your balance in full without incurring interest.

How the Grace Period Works:

Let’s say:

- Your billing cycle ends on June 1.

- Your due date is June 25.

- You pay your full statement balance by June 25.

Result? No interest charged.

But if you carry even ₹1 over to the next cycle, you lose the grace period and will be charged interest on all purchases.

How to Maximize the Grace Period:

- Pay your full balance on time every month

- Track your billing cycle dates

- Avoid carrying forward any unpaid balance

Using the grace period wisely is one of the simplest yet smartest credit card repayment strategies.

Why You Should Avoid Only Paying the Minimum Amount

The credit card minimum payment is usually around 2-5% of your total balance. While it helps you avoid late fees, it’s a trap that keeps you in debt longer and costs you more in interest.

Example:

| Balance | APR (Annual Interest Rate) | Minimum Payment | Time to Pay Off | Total Interest Paid |

|---|---|---|---|---|

| ₹50,000 | 36% | ₹2,500/month | 32 months | ₹30,800+ |

| ₹50,000 | 36% | ₹5,000/month | 12 months | ₹10,400+ |

Paying more than the minimum reduces both the interest and the time to become debt-free. This is a core principle in any effective credit card repayment strategy.

Best Credit Card Repayment Strategies to Get Out of Debt Fast

- Avalanche Method

Pay off cards with the highest interest rate first while making minimum payments on others.

Pros: Saves the most on interest

Best for: People focused on total cost reduction - Snowball Method

Pay off the smallest balances first to gain momentum, then tackle larger ones.

Pros: Builds motivation through small wins

Best for: People who need emotional reinforcement - Debt Consolidation

Combine multiple credit card debts into a single loan with a lower interest rate or use a balance transfer credit card.

Pros: Easier to manage, often at lower rates

Caution: May involve balance transfer fees or time limits - Increase Your Monthly Payments

Use income from side gigs, selling items, or budget cuts to increase monthly payments.

Pros: Accelerates debt reduction

Tip: Automate extra payments to stay consistent - Use Windfalls Wisely

Tax refunds, bonuses, or gift money should go straight toward your credit card debt.

Pros: Immediate impact on reducing total balance

Mindset: Treat windfalls as tools, not spending sprees

Summary: Which Repayment Strategy Works Best?

Here’s a quick comparison to help you decide:

| Strategy | Best For | Key Benefit | Watch Out For |

|---|---|---|---|

| Avalanche Method | Cost-conscious debt managers | Lowest total interest paid | Takes longer to feel progress |

| Snowball Method | Motivation-driven individuals | Quick psychological wins | May cost more in interest |

| Balance Transfer Card | Those with good credit scores | 0% interest for intro period | Reverts to high APR later |

| Personal Loan (Consolidation) | Simplifying multiple debts | Fixed repayment plan | May extend debt timeline |

| Increased Payments | Those with budget flexibility | Faster payoff, less interest | Requires discipline |

Frequently Asked Questions (FAQs)

Q1: How much should I pay monthly on my credit card?

Aim to pay the full statement balance to avoid interest. If not possible, pay as much above the minimum as you can afford.

Q2: Can I regain my grace period after losing it?

Yes. To regain the credit card grace period, you must pay off your entire balance in full and on time for at least one full billing cycle.

Q3: Is paying the minimum ever okay?

Only in emergencies. Relying on credit card minimum payments will prolong debt and cost significantly more in interest.

Q4: Should I close a paid-off credit card?

Not necessarily. Keeping it open helps your credit utilization ratio and credit history length, both of which impact your credit score.

Q5: How does my payment strategy affect my credit score?

Timely, full payments improve your score. High balances or late payments hurt it. Using smart credit card repayment strategies helps maintain good credit.

Track Your Credit Score for Free

Staying on top of your credit score is a vital part of effective credit card repayment strategies. Here are some trusted platforms to monitor your score and get monthly updates:

- CIBIL – India’s most widely used credit bureau. www.cibil.com

- Experian India – Offers free credit reports and monitoring. www.experian.in

- BankBazaar – Compare credit scores and credit card offers. www.bankbazaar.com

Test Your Credit Knowledge

Think you’re using your credit card wisely? Take our quick quiz to assess your financial habits and learn where you can improve:

Q1: What happens if you only pay the minimum due each month?

- A) Your debt is cleared faster

- B) You pay more interest over time ✅

- C) Your credit score instantly improves

Final Thoughts: Build Better Habits for Financial Freedom

Understanding how the credit card grace period works, creating a fast-track credit card debt repayment plan, and avoiding reliance on the credit card minimum payment are crucial habits for financial health.

By following the right credit card repayment strategies, you’ll avoid unnecessary interest, improve your credit score, and gain peace of mind.