Agriculture loan in India is a vital financial lifeline for farmers and agri-entrepreneurs striving to grow their operations. With agriculture employing more than 50% of the country’s workforce, access to timely and affordable credit is essential for maintaining productivity and ensuring economic stability in rural areas. These loans help fund a wide range of activities—from purchasing seeds, fertilizers, and equipment to developing irrigation systems and infrastructure. By offering flexible repayment terms and government-backed subsidies, an agriculture loan in India empowers the farming community to invest confidently, improve yields, and contribute to the nation’s food security and rural development.

Table of Contents

What is an Agriculture Loan?

An agriculture loan is a credit facility extended to farmers and agribusinesses for farming and related activities. It includes both short-term (like crop loans) and long-term (like machinery or infrastructure) funding options. These loans help address seasonal capital requirements, mitigate risks, and boost productivity.

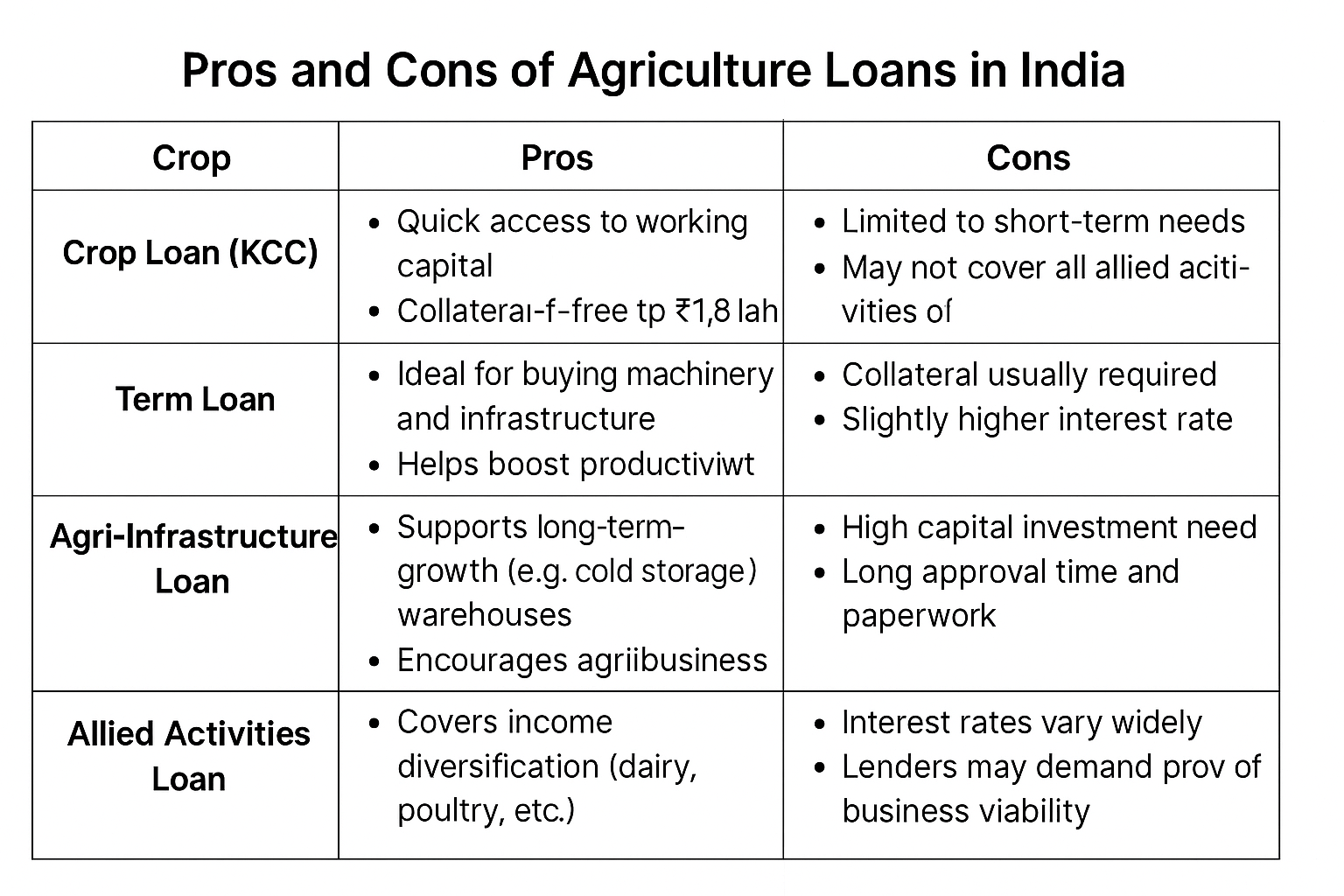

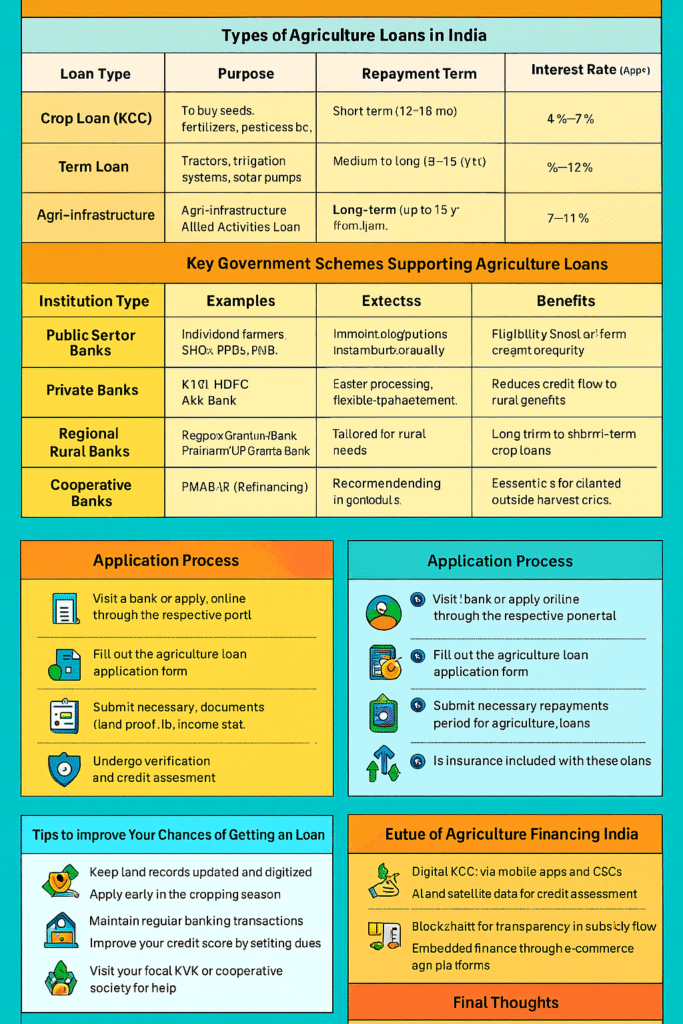

Types of Agriculture Loans in India

| Loan Type | Purpose | Repayment Term | Collateral Required | Interest Rate (Approx.) |

|---|---|---|---|---|

| Crop Loan (KCC) | To buy seeds, fertilizers, pesticides, etc. | Short term (12-18 mo) | Not required up to ₹1.6 lakh | 4% – 7% (with subvention) |

| Term Loan | Tractors, irrigation systems, solar pumps | Medium to long (3–15 yr) | Required (above ₹1.6 lakh) | 7% – 12% |

| Agri-Infrastructure | Warehouses, cold storages, grading units | Long-term (up to 15 yr) | Yes | 7% – 11% |

| Allied Activities Loan | Dairy, poultry, fisheries, beekeeping | Medium term | May vary by loan size | 8% – 12% |

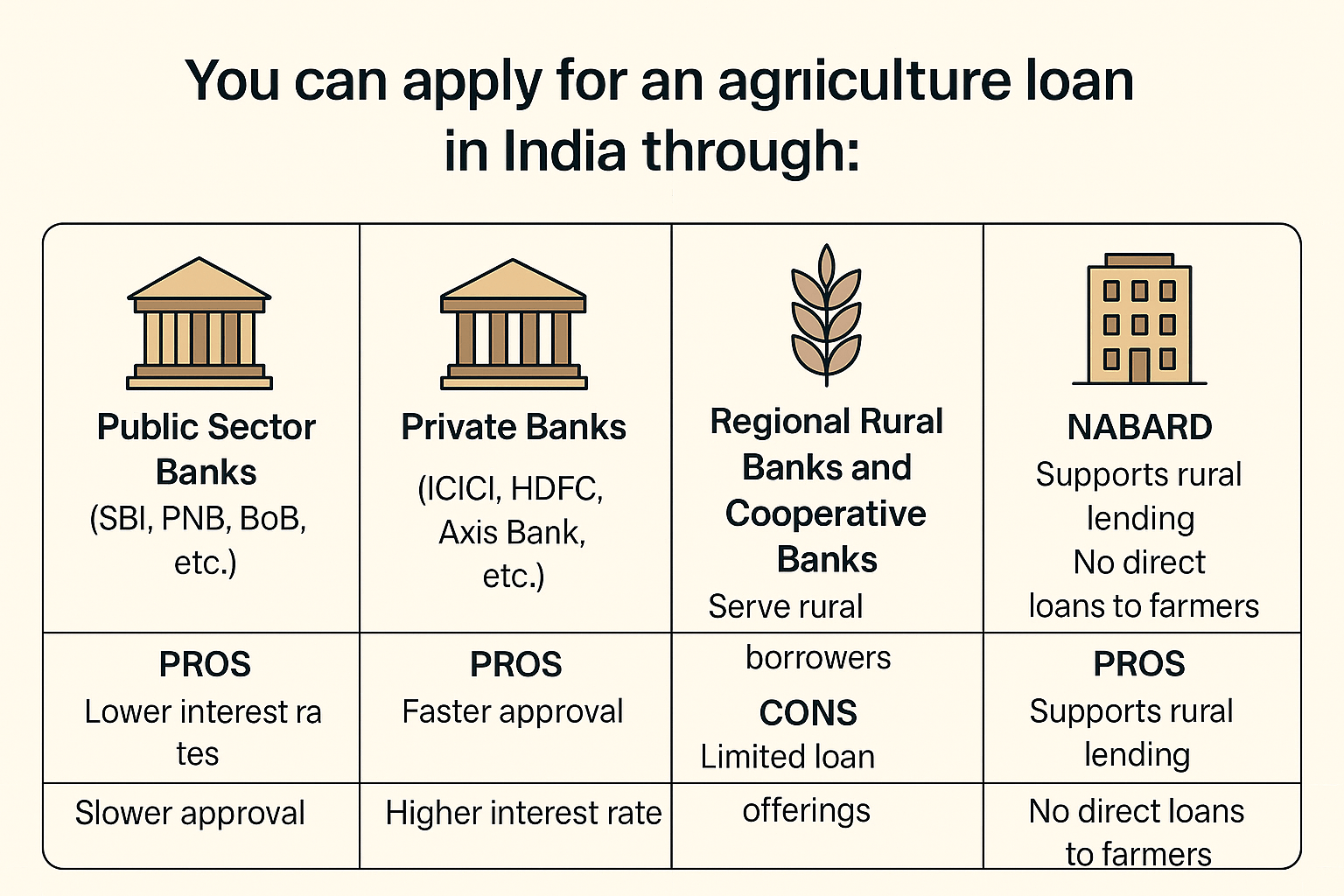

Major Providers of Agriculture Loans

| Institution Type | Examples | Features |

|---|---|---|

| Public Sector Banks | SBI, Bank of Baroda, PNB | Lower interest rates, rural network |

| Private Banks | ICICI, HDFC, Axis Bank | Faster processing, flexible options |

| Regional Rural Banks | Kerala Gramin Bank, Prathama UP Gramin Bank | Tailored for rural needs |

| Cooperative Banks | State & District Co-op Banks | Often cater to small farmers |

| NABARD (Refinancing) | Supports lending institutions indirectly | Expands credit supply to rural sector |

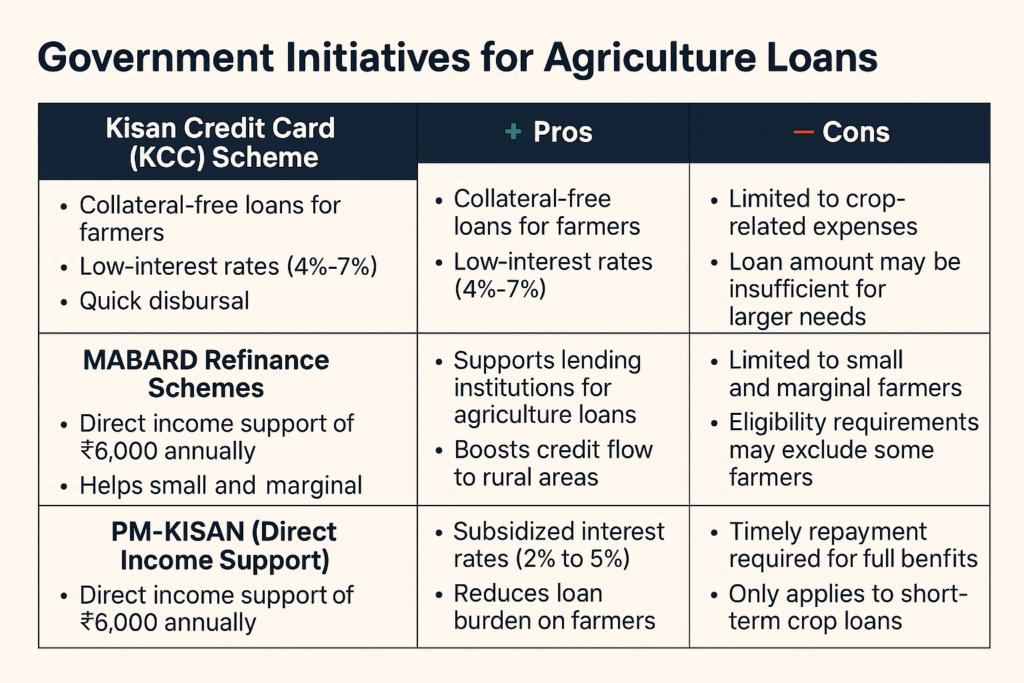

Key Government Schemes Supporting Agriculture Loans

| Scheme Name | Objective | Benefits |

|---|---|---|

| Kisan Credit Card (KCC) | Short-term credit for crop expenses | Interest subvention, easy credit access |

| PM-KISAN | Income support for small farmers | ₹6,000 annually to eligible families |

| Interest Subvention Scheme | Reduce interest burden on crop loans | 2% subvention + 3% for timely repayment |

| Agriculture Infrastructure Fund (AIF) | Finance agri-infrastructure projects | Long-term loans with 3% interest subsidy |

| PM Fasal Bima Yojana (PMFBY) | Crop insurance | Protection against crop failure due to natural risks |

Eligibility Criteria for Agriculture Loans

| Criteria | Details |

|---|---|

| Applicant Type | Individual farmers, SHGs, FPOs, tenant farmers, agri-startups |

| Age Limit | Usually 18 to 70 years |

| Documents Required | Land records, Aadhaar, bank statements, ID proof |

| Credit Score | Some banks require CIBIL score of 650–700+ |

Application Process

- Visit a bank or apply online through the respective portal.

- Fill out the agriculture loan application form.

- Submit necessary documents (land proof, ID, income statement).

- Undergo verification and credit assessment.

- Receive loan approval and disbursal.

Challenges and Difficulties in Getting an Agriculture Loan in India

- Complex Documentation Process: Many farmers lack proper land titles or lease agreements, making verification difficult.

- Lack of Financial Literacy: Low awareness about procedures and schemes often leads to ineligibility.

- Collateral Requirements: Loans above ₹1.6 lakh usually require collateral.

- Credit History Issues: Poor or no credit score can lead to rejections.

- Bureaucratic Delays: Especially with public sector banks.

- Inadequate Loan Amount: Loan amounts sanctioned may not meet the actual financial needs.

- Seasonal Income Issues: Repayment schedules may not align with harvest cycles.

Common Myths About Agriculture Loans in India

| Myth | Reality |

|---|---|

| Only landowners can apply | Tenant farmers can apply with valid lease or cultivation proof |

| All loans require collateral | KCC offers collateral-free loans up to ₹1.6 lakh |

| Interest rates are always high | Subsidized rates are as low as 4% |

| Only banks offer agri loans | NBFCs, cooperatives, and MFIs also provide credit |

| It takes months to get an agri loan | Many banks offer quicker digital processing |

Tips to Improve Your Chances of Getting an Agriculture Loan

- Keep land records updated and digitized

- Apply early in the cropping season

- Maintain regular banking transactions

- Improve your credit score by settling dues

- Visit your local KVK or cooperative society for help

Future of Agriculture Financing in India

- Digital KCC via mobile apps and CSCs

- AI and satellite data for credit assessment

- Blockchain for transparency in subsidy flow

- Embedded finance through e-commerce agri platforms

Frequently Asked Questions (FAQs)

1. What is the interest rate for agriculture loans in India?

Interest rates vary from 4% to 12%, depending on the scheme and lender.

2. Can small and marginal farmers get collateral-free loans?

Yes, KCC loans up to ₹1.6 lakh are collateral-free.

3. What is the maximum repayment period for agriculture loans?

Up to 15 years for term loans; crop loans are repaid in 12–18 months.

4. Is insurance included with these loans?

Yes, especially crop loans linked with PMFBY.

5. Can tenant farmers apply for agriculture loans?

Yes, with lease agreements or cultivation proof.

Final Thoughts

An agriculture loan in India can be a game-changer for farmers who need timely financial support. Whether for crop inputs or capital expenditure, these loans are instrumental in ensuring growth and resilience in the agricultural sector.

Before applying, compare interest rates, repayment terms, and eligibility criteria across banks and schemes. Take advantage of government subsidies and guidance from agricultural support centers.

Explore more on how to take your farm to the next level:

Loan Against Agriculture Land in India (2025): Best Banks, Interest Rates & Eligibility

Empower your farming journey with the right financial knowledge. Stay updated. Stay ahead.