In today’s fast-moving digital landscape, loan apps in India have revolutionized the way people access credit. No longer do you need to stand in long queues or navigate complicated paperwork—these digital platforms bring instant financial solutions right to your fingertips. Whether you’re a student needing funds for education, a salaried professional managing monthly expenses, or a small business owner tackling cash flow gaps, loan apps in India cater to diverse needs with speed and convenience. In this guide, we dive into the top-performing apps, RBI-compliant platforms, student loan options, and everything else you need to make informed borrowing decisions in 2025.

Table of Contents

What Are Loan Apps?

Loan apps are digital platforms, usually mobile-based, that provide quick personal, educational, or emergency loans without the need for visiting a bank or providing heavy documentation. These apps use technology to verify user data, assess creditworthiness, and process loans swiftly.

Benefits of Using Loan Apps:

- Instant processing and fund disbursal

- Minimal paperwork with digital KYC

- Available 24/7

- Loans for both salaried and self-employed individuals

- Microloans for daily or emergency expenses

RBI-Approved Loan Apps in India

Loan apps approved by the Reserve Bank of India (RBI) follow strict compliance and security protocols. They either function as registered NBFCs or are tied with regulated financial institutions.

| App Name | Loan Amount | Interest Rate | Tenure | RBI-Registered Partner |

|---|---|---|---|---|

| Navi | Up to ₹20 Lakhs | From 9.9% p.a. | 12-72 months | Navi Finserv |

| KreditBee | ₹1,000–2 Lakhs+ | 17%–29.95% p.a. | 3–36 months | Krazybee Services |

| MoneyTap | ₹3,000–5 Lakhs | From 13% p.a. | 2–36 months | Partnered NBFCs |

| Fibe (EarlySalary) | ₹5,000–5 Lakhs | From 12% p.a. | 3–24 months | Social Worth Technologies |

| PaySense | ₹5,000–5 Lakhs | 16%–28% p.a. | Up to 60 months | Credit Saison India |

These apps are suitable for users seeking secure, mid- to high-value personal loans with predictable terms and a strong customer support system.

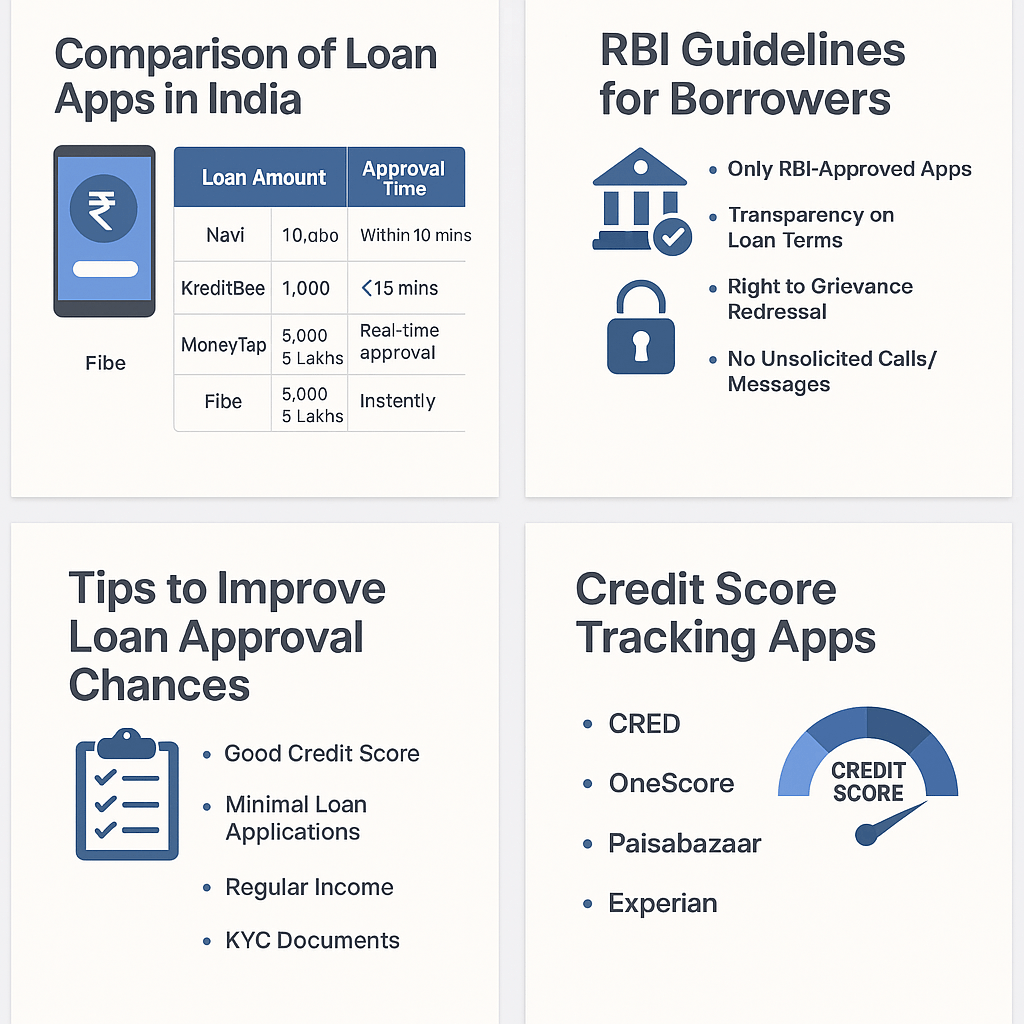

Instant Loan Apps in India

Instant loan apps cater to users needing quick cash for emergencies, small purchases, or unexpected bills. They often use AI and data analytics to approve loans within minutes.

| App | Loan Range | Approval Time | Interest | Highlights |

|---|---|---|---|---|

| Navi | ₹10,000–20 Lakhs | <10 mins | From 9.9% p.a. | No paperwork, instant approval |

| KreditBee | ₹1,000–2 Lakhs | <15 mins | Up to 30% p.a. | Suitable for gig workers and students |

| MoneyTap | ₹3,000–5 Lakhs | Real-time | From 13% | Flexible credit line |

| Fibe | ₹5,000–5 Lakhs | Instant | Avg 1.5% monthly | Great for salary advances |

| CASHe | ₹1,000–4 Lakhs | Few hours | 2–3.5% monthly | AI-driven loan evaluation |

Use Cases:

- Emergency medical expenses

- Bill payments and travel bookings

- Unexpected home repairs

- Personal needs and gadget purchases

Student Loan Apps in India

Student loan apps provide microloans and education funding for students who may not have access to traditional banking services. These platforms are popular among college-goers, online learners, and students preparing for competitive exams.

| App | Loan Amount | Interest | Target Users | Unique Feature |

|---|---|---|---|---|

| mPokket | ₹500–30,000 | 1.5%–4%/month | College students | Instant transfer, low documentation |

| KreditBee | ₹1,000–2 Lakhs | Student-specific offers | Youth and students | Minimal credit history needed |

| Eduvanz | ₹50,000–20 Lakhs | Custom rates | Skill and degree students | Collaborations with edtechs |

| Leap Finance | ₹10 Lakhs+ | Varies | Study abroad aspirants | Loans for global education |

| Slice | ₹2,000–1 Lakh | 0% for limited time | Young adults | Credit card alternative |

Popular Purposes:

- Exam/course fees

- Laptop/gadget financing

- Study abroad funding

- Coaching classes and certifications

Additional Loan Categories Worth Exploring

1. Business Loan Apps

For small businesses and self-employed professionals:

- Indifi: Loans based on business invoices

- LendingKart: Offers unsecured working capital

- FlexiLoans: Merchant loans with quick approval

2. Buy Now, Pay Later (BNPL) Apps

For retail shopping and subscriptions:

- ZestMoney

- Simpl

- LazyPay

- SlicePay

Tips to Improve Loan Approval Chances

- Maintain a good credit score (preferably 700+)

- Limit multiple loan applications—too many requests can lower approval odds

- Provide correct and verifiable details (KYC and bank statements)

- Use apps you have transaction history with (wallets, salary accounts)

- Pay EMIs on time to build positive repayment history

Detailed RBI Guidelines and Borrower Rights

The Reserve Bank of India has issued digital lending norms to ensure transparency and borrower protection:

- Digital Lenders must disclose total cost of the loan (APR)

- No automatic credit push without user consent

- All loan agreements must be digitally signed and shared

- Borrowers have a right to grievance redressal via the lender and RBI Ombudsman

- No abusive recovery tactics permitted—report to Cyber Helpline 1930 if harassed

Credit Score Tracking Apps

Keeping an eye on your credit score improves your borrowing potential:

- CRED – Offers score tracking and rewards

- OneScore – Clean interface, real-time alerts

- Wishfin – Tracks score and offers improvement tips

- Bajaj Finserv Experia – Score plus loan offers in one app

Alternatives to Loan Apps in India

If you want non-app options, consider:

- Government Schemes: Mudra Loans, Stand Up India, Vidya Lakshmi

- Peer-to-peer lending platforms like Faircent, LenDenClub

- Credit Co-operative Societies for rural or low-income borrowers

- Microfinance Institutions (MFIs) for women entrepreneurs and farmers

Safety Tips for Using Loan Apps

- Choose only RBI-registered platforms or those partnered with regulated NBFCs.

- Verify the privacy policy—avoid apps requesting unnecessary permissions.

- Check interest rates, fees, and penalties clearly before borrowing.

- Avoid apps demanding upfront payments before disbursing loans.

- Report suspicious apps to RBI Sachet Portal or Cyber Helpline (1930).

Frequently Asked Questions (FAQs)

Q1. Are instant loan apps safe? A: Yes, if the app is RBI-approved or partnered with a registered NBFC. Always read reviews and check privacy policies.

Q2. Can students get loans without income proof? A: Yes, platforms like mPokket and KreditBee offer loans based on student ID and minimal documentation.

Q3. What are the penalties for late repayment? A: Penalties vary by app and can include late fees, increased interest, and impact on your credit score.

Q4. How quickly can I get the money? A: Some apps like Navi and Fibe can disburse funds within 10–30 minutes of approval.

Q5. Are there 0% interest options? A: Slice and LazyPay sometimes offer 0% interest for select users or repayment periods.

Final Thoughts

Loan apps in India have become a crucial financial tool in 2025—empowering students, working professionals, freelancers, and small business owners alike. From instant approvals to flexible EMIs and zero-collateral requirements, these apps offer unmatched convenience. However, users should borrow responsibly, read terms thoroughly, and avoid falling into debt traps.

By focusing on transparent, regulated platforms and using loans wisely, you can leverage the power of digital credit to meet your goals without compromising your financial health.

Explore Our Recommendations

Looking for Loans? Get personalized advice instantly. No Credit Check Personal Loans: Instant Online Approval, Guaranteed Options for Bad Credit Borrowers.

Need Help Choosing a Loan App?

Drop your questions in the comments or reach out to our team—our experts are here to help you find the best financial solution!