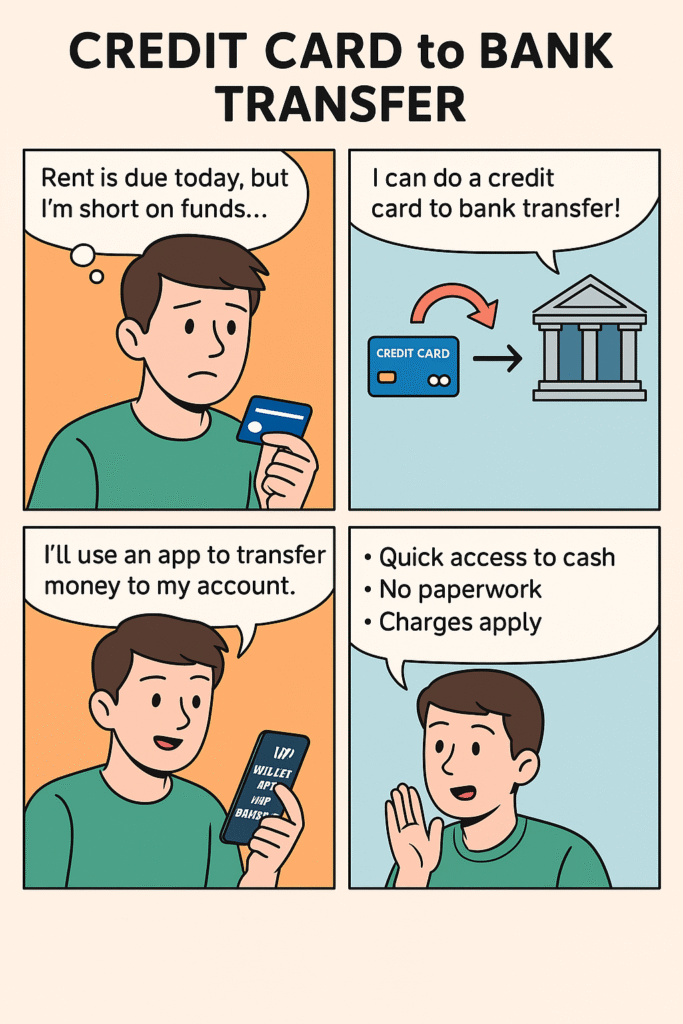

In today’s fast-paced world, there are times when you may need quick access to cash—be it for emergency expenses, rent, or bill payments. One often-overlooked but highly effective method is a credit card to bank transfer.

But this financial tool isn’t without its risks. If used unwisely, it can quickly rack up fees and interest.

Table of Contents

What Is a Credit Card to Bank Transfer?

A credit card to bank account transfer allows you to use your credit limit to deposit money directly into your bank account. This transfer can be done via:

- Direct bank transfer (NetBanking or mobile apps)

- ATM withdrawal (cash advance)

- Wallet apps like Paytm or Mobikwik

However, this is often treated as a cash advance, which means interest charges begin immediately, unlike regular credit card purchases.

Which Banks Allow Credit Card to Bank Transfers?

Here’s a comparison table of major Indian banks and their offerings related to credit card to bank transfers:

| Bank Name | Transfer Option | Interest / Fees | Transfer Speed | Special Notes |

|---|---|---|---|---|

| HDFC Bank | SmartEMI, Balance Transfer | 1.1%–2.5% + GST | Instant (in-bank) | Only HDFC to HDFC is often instant |

| ICICI Bank | Insta FlexiCash | Varies; some zero-interest | Same-day | Up to 45-day interest-free in promos |

| Axis Bank | Balance Transfer | Up to 3.5% | 24–48 hours | Check eligibility in app |

| Kotak Mahindra Bank | Mobile Banking Transfer | 2%–3.5% | Instant | Flexible repayment |

| SBI | Balance Transfer (BT) | 2.5% + GST | 2–3 working days | No instant transfer support |

Third-Party Apps for Credit Card to Bank Transfer

Can’t transfer directly via your bank? Don’t worry. These third-party apps offer smart alternatives:

| App Name | Supports Credit Card | Transfer to Bank | Fee Range | Notes |

|---|---|---|---|---|

| Paytm | ✅ | ✅ | ~2.5% + GST | Instant transfer, max limits may apply |

| Mobikwik | ✅ | ✅ | ~3% | Offers ZIP PayLater, cashback at times |

| PhonePe | Limited | Indirect via wallets | Varies | Not all wallets support credit card top-ups |

| Cred | ✅ | Only in special offers | Depends on offers | Offers cash management + bill tracking |

💡 Tip: Always check the wallet’s latest policy. Many apps now limit or disallow direct transfers using credit cards.

Credit Card to Bank Transfer Charges (Full Breakdown)

Let’s break down all possible charges you might incur:

| Charge Type | Typical Fee Range |

|---|---|

| Transaction Fee | 1% to 3.5% |

| Interest Rate (Monthly) | 1.5% to 3.5% |

| Annual Interest (if unpaid) | 18% to 42% |

| GST | 18% on fees |

| Wallet Processing Fee | ₹100 – ₹500 or % based |

When Should You Use Credit Card to Bank Transfers?

✔ Use it when:

- You have a short-term emergency

- You’re sure you can repay within a month

- Promotional offers are available (e.g., 0% interest)

❌ Avoid it when:

- You’re already carrying a credit balance

- You can get a personal loan at better rates

- You’ll need more than a few months to repay

Credit Card Transfer vs. Personal Loan vs. BNPL

When deciding whether to use a credit card to bank transfer, consider the alternatives. Here’s how it compares:

| Feature | Credit Card Transfer | Personal Loan | BNPL (Buy Now Pay Later) |

|---|---|---|---|

| Approval Time | Instant | 24–72 hours | Instant |

| Interest Rate | 18–42% | 10–18% | 0–24% |

| Repayment Flexibility | Medium | High | High |

| Tenure | Short (up to 90 days) | 12–60 months | 15–90 days |

| Suitable For | Urgent expenses | Large planned spends | Small daily needs |

💡 Tip: Use credit card transfers for emergencies, personal loans for larger, longer-term needs, and BNPL for low-ticket items.

Quick Case Study: Which App is Best?

We tested 3 platforms using the same card and ₹10,000 transfer:

| App | Transfer Time | Fees Charged | Ease of Use | Remarks |

|---|---|---|---|---|

| Paytm | ~1 minute | ₹250 + GST | ⭐⭐⭐⭐⭐ | Fast, intuitive UI |

| Mobikwik | ~5 minutes | ₹300 + GST | ⭐⭐⭐⭐ | High fees but reliable |

| Cred | Offer-dependent | 0–2.5% | ⭐⭐⭐⭐ | Limited-time offers; check app |

Legal and Compliance Considerations

While credit card to bank transfers are legal in India, here are some things to know:

- RBI Guidelines: Most transfers are allowed as long as they’re not used for illegal transactions or business credit rotation.

- Tax Impact: Large or frequent transfers might attract scrutiny under income tax rules if flagged as suspicious.

- App Terms: Some wallets may prohibit transferring money received from a credit card to certain bank types (e.g., NRE accounts).

Always read the fine print when using third-party platforms to avoid account restrictions.

Recommended Reads to Boost Your Credit Knowledge

- 🔗 Top 15 Credit Card Offers in 2025 – Save More Every Swipe!

- 🔗 Instant Loan vs Credit Card Loan: Which is Better for You in 2025?

- 🔗 The Ultimate Guide to Loan Apps in India

- 🔗 2025 Guide: Personal Loan Calculator for Big Savings

Frequently Asked Questions (FAQ)

1. Is credit card to bank transfer legal in India?

Yes, it is legal. However, misuse for rotating credit or laundering is not. Always use legitimate platforms.

2. Will this affect my credit score?

Yes, if you utilize too much of your credit limit or miss repayments, your credit score can drop.

3. Can I transfer money from credit card to bank without charges?

Rarely. Some banks offer 0% interest offers for limited periods, but most transfers involve fees.

4. Which is better – credit card transfer or personal loan?

Personal loans usually offer lower interest if you need cash for longer durations. Use credit card transfers only for short-term, urgent needs.

5. Are there monthly limits on such transfers?

Yes. Each wallet or bank may have a cap (e.g., ₹10,000–₹1,00,000 per month). Check with your provider.

A credit card to bank account transfer can be a life-saver—if used responsibly. Know the costs, pick the right platform, and always plan repayment in advance. If used carelessly, this option could spiral into long-term debt.

Want to avoid the charges? Explore our guide on Credit Card Payment Cashback: 5 Proven Tips or Credit Card vs Personal Loan: Which Offers Lower Interest Rates?