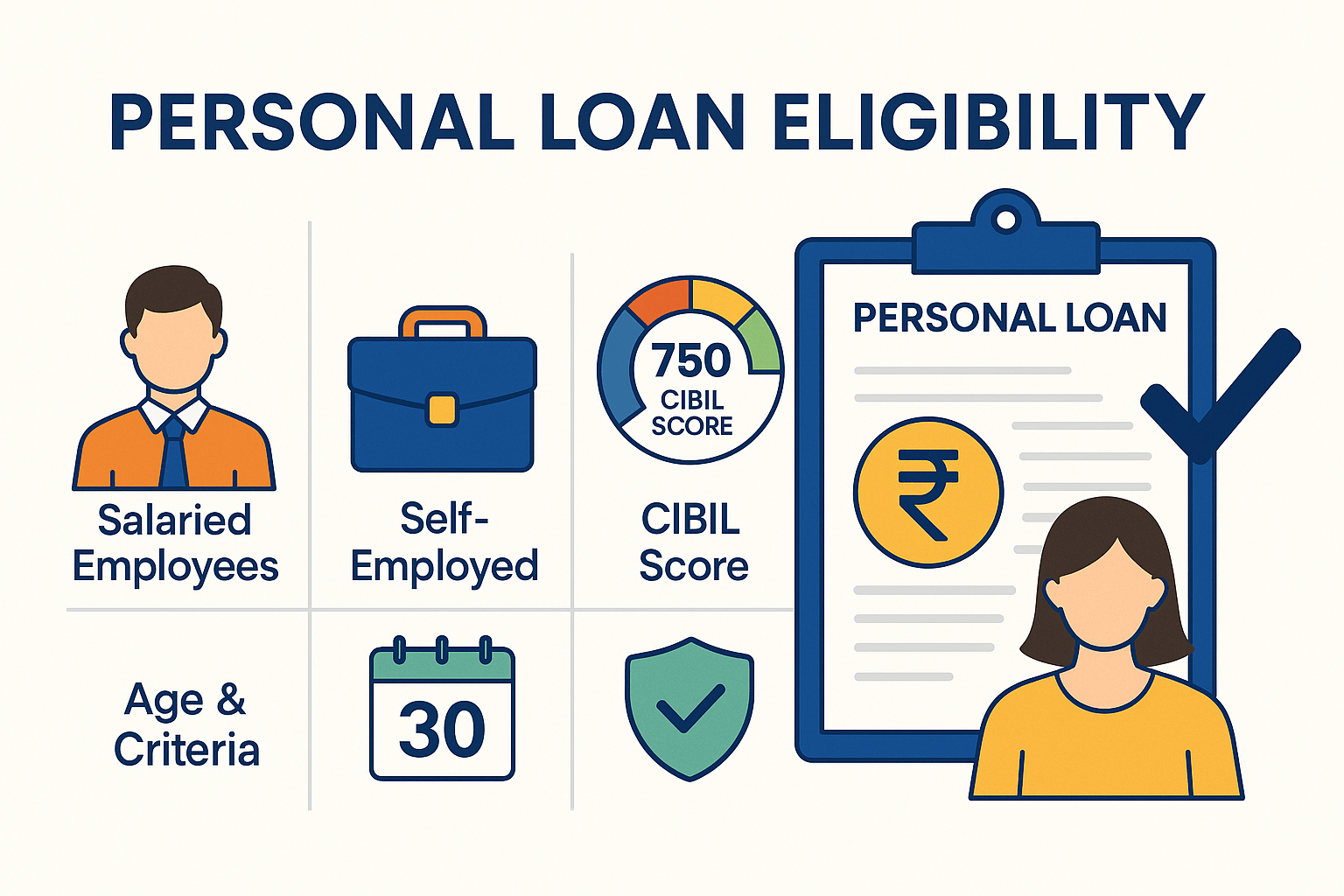

Personal loans are a popular way to manage financial needs, from consolidating debt to funding personal dreams. However, before applying, understanding the personal loan eligibility criteria is critical. A clear idea of eligibility can save you from rejections, unnecessary hard credit inquiries, and even help secure better interest rates.

In this detailed guide, we’ll explore everything you need to know about personal loan eligibility for salaried employees, self-employed professionals, and first-time borrowers, along with tips to boost your chances.

Table of Contents

What is Personal Loan Eligibility?

Personal loan eligibility refers to the conditions a borrower must fulfill to qualify for a personal loan. These conditions vary across lenders but typically revolve around your income, age, employment status, credit history, and existing financial obligations.

Meeting these criteria not only increases approval chances but can also get you better loan offers.

Personal Loan Eligibility Criteria at a Glance

Here’s a quick overview of common eligibility criteria for different borrower categories:

| Criteria | Salaried Employees | Self-Employed Professionals | First-Time Borrowers |

|---|---|---|---|

| Minimum Age | 21 years | 25 years | 21 years |

| Maximum Age | 60 years (at loan maturity) | 65 years (at loan maturity) | 60 years |

| Minimum Income | ₹20,000–₹30,000 per month | Annual turnover of ₹2–₹5 lakh | ₹20,000+ per month |

| Employment/Business Stability | 6 months–1 year in current job | 2–3 years in current business | Stable income for at least 6 months |

| CIBIL Score | 700+ preferred | 700+ preferred | 700+ preferred (or alternative proof) |

| Other Requirements | Reputed employer preferred | Proper financial documentation | May need co-applicant or guarantor |

Personal Loan Eligibility for Salaried Employees

Salaried individuals enjoy easier eligibility, thanks to their steady income.

Key Requirements:

- Full-time employment with a reputable organization.

- Minimum monthly salary as defined by the lender.

- Minimum 6-12 months of continuous employment.

- Good credit score (preferably 750+).

Personal Loan Eligibility for Self-Employed Professionals

Self-employed individuals can qualify with stable income and proper business documentation.

Key Requirements:

- Professionals like doctors, lawyers, CAs, architects, business owners.

- Minimum 2-3 years of successful business operation.

- Steady cash flows and proper filing of tax returns.

- Audited financial statements strengthen the application.

Importance of CIBIL Score in Loan Eligibility

Your CIBIL score reflects your credit behavior and plays a crucial role in loan approval.

- 750 and above: Excellent (quick approvals, low-interest rates)

- 650-749: Average (moderate interest rates)

- Below 650: Risky (loan rejection likely)

Maintaining a healthy score can significantly improve your borrowing potential.

Age and Basic Criteria

Besides income and credit history, lenders also focus on:

- Age: Generally between 21 and 60 years.

- Nationality: Indian citizenship is mandatory.

- Employment stability: Longer the better.

- Debt-to-Income Ratio: Preferably under 40-50%.

First-Time Borrowers: Special Focus

First-time borrowers without a credit history face unique challenges but can still qualify.

Tips for First-Time Applicants:

- Start with a smaller loan amount.

- Use a secured credit card to build a credit history beforehand.

- Maintain a stable income.

- Consider applying with a guarantor.

Some fintech lenders now provide loans specially designed for first-time borrowers with simplified documentation and quick approval processes.

Use a Personal Loan Eligibility Calculator

A personal loan eligibility calculator is a smart tool that instantly estimates your loan amount based on your salary, EMIs, tenure, and other factors.

Benefits:

- Saves time

- Helps avoid unnecessary rejections

- Fine-tunes your loan application

Always use calculators from trusted banks or fintech websites for the best accuracy.

Common Mistakes That Hurt Eligibility

- Applying for too many loans at once.

- Ignoring errors on your credit report.

- Changing jobs too frequently.

- Having too many active loans already.

Being mindful of these mistakes can make a significant difference in getting approved.

Quick Ways to Improve Your Loan Eligibility

- Repay existing debts before applying.

- Increase your monthly income (e.g., through freelance gigs).

- Correct inaccuracies on your credit report.

- Avoid taking new credit close to applying for a personal loan.

Even small improvements can raise your eligibility quickly.

Impact of Existing Loans on New Loan Applications

Your existing EMIs affect your capacity for new loans.

Lenders prefer if your total EMI obligations are less than 40%-50% of your monthly income.

If your EMI load is too high, consider closing smaller loans first to improve your chances.

Documents Required for Personal Loan Approval

Always keep these documents handy to speed up approval:

- PAN Card

- Aadhaar Card or Passport

- Salary slips (for salaried)

- Income Tax Returns (for self-employed)

- Bank statements

- Business proof (for self-employed)

Pre-Approved Personal Loans: What They Mean

If your bank already has your transaction history and you maintain a good credit score, you may receive a pre-approved personal loan offer.

Benefits:

- Instant approval

- Minimal documentation

- Competitive rates

However, a pre-approved offer is subject to final verification, so always double-check before accepting.

FAQs on Personal Loan Eligibility

Q1. What is the minimum CIBIL score needed for a personal loan?

A1. Ideally, a score above 700 is required, but some lenders approve loans for scores above 650 at slightly higher interest rates.

Q2. Can I get a personal loan without a salary slip?

A2. It’s difficult, but self-employed individuals can apply using bank statements and IT returns.

Q3. How does changing jobs affect my personal loan eligibility?

A3. Frequent job changes can lower eligibility. Lenders prefer applicants with stable employment history.

Q4. How much personal loan can I get based on my salary?

A4. Generally, lenders offer up to 20-24 times your monthly salary as a personal loan, depending on other factors like existing EMIs and your credit score.

Q5. Can first-time borrowers get a personal loan?

A5. Yes, many lenders offer tailored products for first-time borrowers with minimal or no credit history, but the loan amount might be lower initially.

Understanding the basics of personal loan eligibility can make your borrowing experience smooth and hassle-free. Whether you’re a salaried employee, a self-employed professional, or a first-time borrower, maintaining a stable financial profile and strong credit behavior will maximize your chances of approval.

Before applying, use an eligibility calculator, review your credit score, and prepare all necessary documents to enjoy a seamless loan experience.

📢 Related Reading:

👉 Best Personal Loan Banks 2025 – Compare Interest Rate (Complete Guide)

Explore this detailed guide to learn how to calculate your ideal loan amount based on your income, EMIs, and financial goals!